Five Common Business Models for Overseas Distributed Energy Storage

Five Common Business Models for Overseas Distributed Energy Storage

1. “Rent to sell” model

Energy storage project developers lease energy storage systems to users to reduce peak electricity charges and demand electricity charges and provide backup power. The lease period can be flexibly set according to target users or product applications, and users pay monthly rent, covering equipment usage fees, operation and maintenance fees, software fees, installation costs, taxes, etc. Energy storage project developers use third-party funds to purchase energy storage systems, and the stable cash flow generated by operating leases serves as the developer’s financing basis.

Most of the monthly rental fees paid by users are fixed amounts. The leasing fee is calculated on the basis of the project investment cost, and the difference between the leasing fee and the savings in the user’s electricity bill largely determines whether the customer is interested in leasing the energy storage equipment. Take the energy storage leasing contract signed by Stem Company and users as an example, sometimes the electricity bill saved by the user is 2 times, sometimes 3 times or 4 times of the rental fee paid to Stem, depending on the actual load reduction of the user every month . According to Stem’s estimates, unless the user saves more than twice the amount of electricity they pay to Stem, it will be difficult to attract customers to install.

“Lease and sale” is currently the most widely used investment and operation model in the field of distributed energy storage. US-based Stem, GreenCharge Networks, and German Entega use this model to provide users with energy storage services.

2. Shared electricity saving revenue model

This model refers to the strategy of sharing energy storage revenue between energy storage project developers and owners. This model is similar to the leasing model, but also has differences. For example, both models require users to pay energy storage asset owners according to a certain percentage or a certain amount of savings. Usually the leasing fee is calculated based on the fixed investment cost of the developer, and it is mostly a fixed amount, while the shared income model is usually divided according to the proportion of the income, and this amount changes according to the amount of electricity saved every month. The revenue sharing mode of saving electricity bills is relatively rare among household users, mainly industrial and commercial users.

In addition, judging from the actual situation of the current development of the two models, when the revenue sharing model is applied alone, the contract period is generally longer, 10 years or more. At the same time, the shared revenue model is often used in combination with the virtual power plant model and community energy storage model. However, the contract period of the lease model shows a short-term trend. For example, Younicos originally provided a lease contract with a minimum period of 2 to 4 years, but from 2019, it can accept monthly rent. Users only need to pay the rent, as well as the deployment and dismantling costs, but there will be no other additional costs or risks.

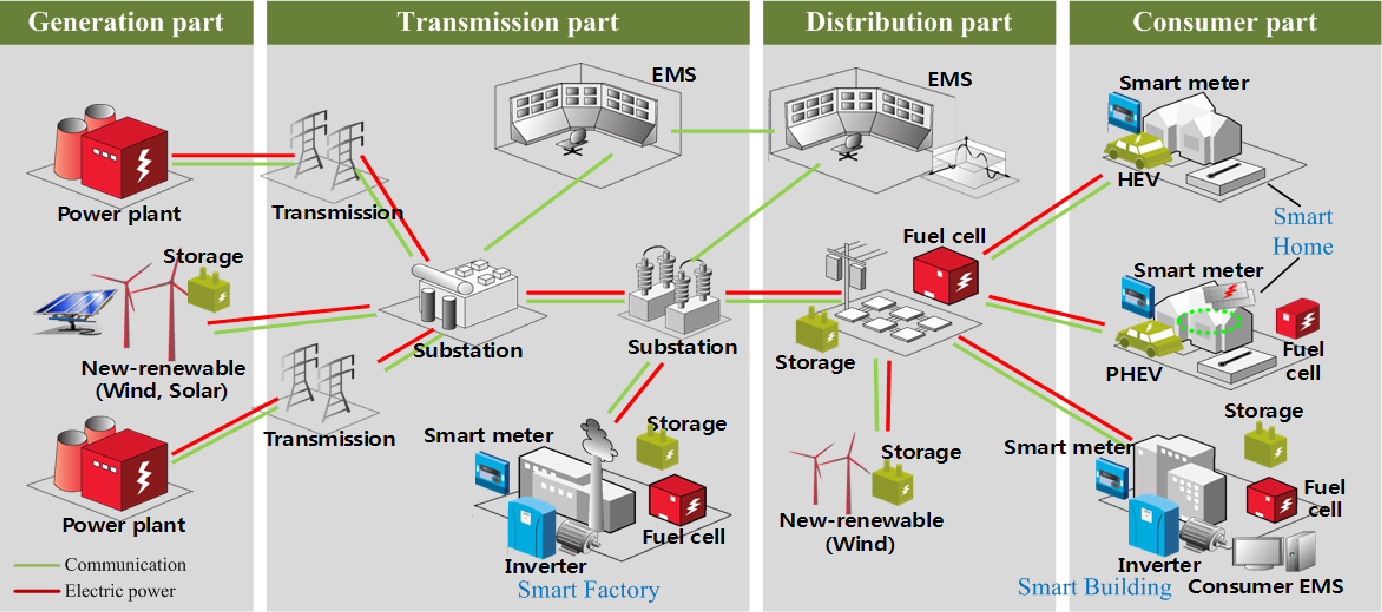

3. Virtual power plant mode

Utilities or third-party companies gather energy storage systems owned by residents, commercial users, and industrial users and connected to the smart grid through a central control room, and participate in grid services to obtain application benefits by analyzing, controlling, and optimizing the operation of energy storage systems . The “virtual power plant” model is the product of energy storage pursuing multiple application values. A distributed energy storage system that undergoes unified scheduling and management can not only participate in the power market to obtain benefits through frequency modulation, reserve capacity and other applications, but also can play a role in voltage support for power transmission and distribution systems, delay power transmission and distribution expansion upgrades, and demand response applications. value. According to GTM Research’s forecast, the annual revenue of global virtual power plants will increase from US$1.5 billion in 2016 to US$5.3 billion in 2023, and the United States will account for US$3.7 billion in 2023. At present, in the international market, Moixa of the United Kingdom, Stem of the United States, and Sonnen of Germany are all using this model to develop revenue channels for energy storage projects for users. Layout of virtual power plant business.

In the virtual power plant mode, the software (some called “cloud platform” or “central control room”) that can aggregate energy storage systems for analysis and optimize control is very critical. The software needs to obtain data from building loads in a certain period of time (Stem’s AI software Athena reads every second), obtain price information from the market, and collect hour-level weather information at the same time. For the information of each building, each market, and each electricity fee, the software needs to manage in real time. When a utility calls for demand response, the software can find optimization points that help users save more money.

4. Community energy storage model

A typical case of the community energy storage model is the Sonnen Community program launched by SonnenBatterrie in Germany in 2015. According to the plan, its members/users store photovoltaic power in battery energy storage, and the stored power is used for self-consumption, power trading among community users, and providing grid services. Power users only need to pay a fixed fee (lower than the electricity fee purchased from the grid). Potential hotspots for this model are Germany, the US and Australia. Australia has been experimenting with this model in the WhiteGum Valley project since late 2016. At the same time, the United States also began to promote this kind of model in some communities.

In addition, in the community energy storage model, in addition to aggregating multi-point energy storage in the region for trading, there is another way to connect many power producers and consumers installed with photovoltaics to an independent large-scale central battery system for power trading. In 2016, Perth, Australia, Alkimos Beach launched a community trial of a similar model, with 100 rooftop photovoltaics connected to 1.1 MWh lithium-ion batteries, and photovoltaic developer Synergy operating and maintaining the system. In 2015, the MVV Strombank project began to demonstrate the community energy storage model, using a large-scale battery energy storage system for community power trading.

5. Other Derivative Models or Hybrid Models

In fact, there are many derivative or hybrid models of the above models in the energy storage market. The more common hybrid model is a mixture of the operating leasing model/shared electricity cost saving revenue model and the virtual power plant model.

For example, in June and August 2017, Stem, Inc. of the United States aggregated its energy storage projects in the leasing mode to build a virtual power plant, participate in spot market transactions and respond to dispatch.

For the derivative model, it is more common at present to combine electricity sales and energy storage to provide energy services to users. For example, the German company SENEC uses energy storage and intelligent management systems to develop a series of energy service packages to provide users with high value-added energy services, providing demonstration samples for other international energy storage equipment suppliers or energy service providers.